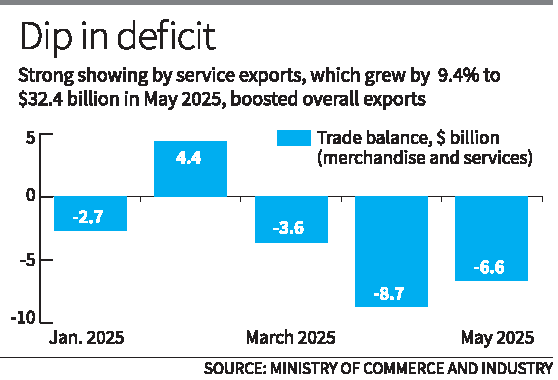

India’s total trade deficit narrows to $6.6 billion as total exports grow

Trade Deficit: Narrowed to $6.6 billion (↓30% YoY) due to:

Falling Oil Prices: Reduced import costs.

Services Export Growth: ↑9.4% ($32.4 billion).

Merchandise Export Decline: ↓2.2% ($38.7 billion).

Non-Petroleum Exports: Grew 5.1%, showing resilience.

Imports:

Merchandise Imports: ↓1.7% (oil impact).

Non-Oil Imports: ↑10%.

Services Imports: ↑1.5%.

Reasons for Trends

Oil Price Volatility: Lower crude prices dampened petroleum exports but cut import bills.

Services Sector Strength: IT, tourism, and remittances drove export growth.

Key Economic Concepts

1. Trade Deficit

Definition: When a country’s imports exceed exports (goods + services).

Impact:

Negative: Can strain forex reserves, weaken currency.

Positive (if managed): Imports may boost industrial growth (e.g., raw materials).

2. Current Account Deficit (CAD)

Definition: Broader than trade deficit, includes:

Trade balance (goods + services).

Net income from abroad (e.g., dividends, interest).

Unilateral transfers (e.g., remittances).

India’s Context: A lower trade deficit helps reduce CAD.

3. Balance of Payments (BoP)

Definition: Record of all economic transactions between a country and the world.

Current Account (trade, income, transfers).

Capital Account (investments, loans, forex reserves).

Equilibrium: BoP must balance (surplus/deficit in current account offset by capital flows).

Why Important for UPSC?

Prelims ( Economy)

Data Points: $6.6B deficit, services export growth, oil price impact.

Concepts: Trade deficit vs. CAD vs. BoP.

Mains (GS-3: Growth & Trade)

Potential Questions:

"Analyze the drivers behind India’s narrowing trade deficit in 2025."

"How does a services-led export growth model impact India’s BoP?"

Key Points

- Trade deficit improved due to oil price drop & services exports.

- Non-oil exports grew 5.1%, signaling diversification.

- CAD & BoP stability depends on sustained export growth and FDI inflows.

- Policy Focus: Reduce oil import reliance, promote manufacturing exports.