Israel-Iran conflict may impact oil supply to India, spike export costs

Israel-Iran Conflict Impact on India

1. Impact on Oil Prices & Inflation

-

Global crude oil prices surged ~8% in one day following Israel’s attack on Iran.

-

India, which imports ~80% of its crude oil, is vulnerable to global oil price shocks, even though direct imports from Iran are low.

-

Inflation risk rises significantly due to this dependence.

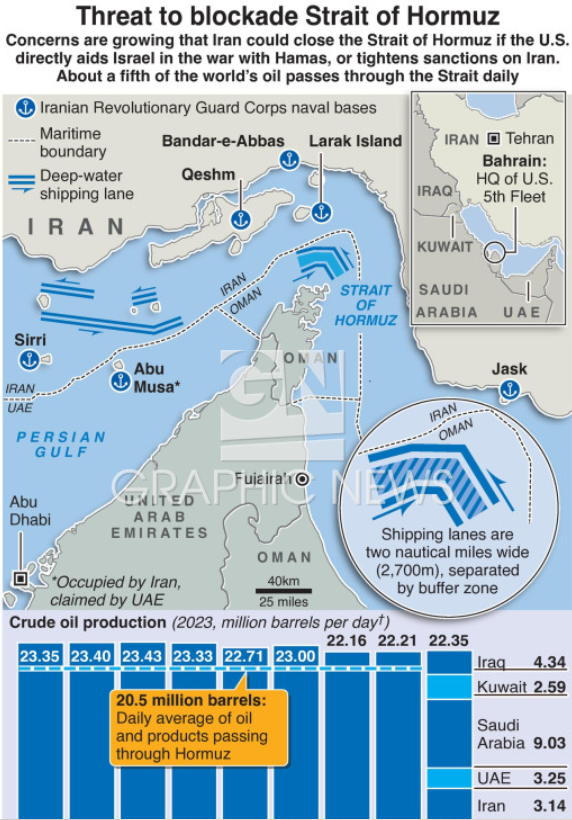

2. Strategic Chokepoint – Strait of Hormuz

-

~20% of global oil trade passes through the Strait of Hormuz (between Iran & Arabian Peninsula).

-

Disruption could affect key suppliers to India: Iraq, Saudi Arabia, UAE.

3. Trade & Export Disruptions

-

Ongoing tensions may lead to closure of the Suez Canal & Red Sea routes.

-

Exports rerouted via Cape of Good Hope will:

-

Add 15–20 days transit time

-

Raise costs by $500–1,000 per container

-

Cause 40–50% increase in export costs

-

4. Impact on Gold & Investor Sentiment

-

Gold prices surged to ₹1 lakh per 10g, seen as a safe haven during geopolitical instability.

-

Analysts note this is part of a broader uptrend driven by:

-

Central bank gold purchases

-

Long-term inflation concerns

-

UPSC PRELIMS MCQ

Q. With reference to the Strait of Hormuz, consider the following statements:

-

It connects the Persian Gulf with the Arabian Sea via the Gulf of Oman.

-

Over 20% of global oil trade transits through it.

-

It is bordered by Iran to the north and Oman to the south.

Which of the statements given above is/are correct?

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

Answer: ✅ D. 1, 2 and 3

Explanation:

All three statements are factually accurate and geopolitically relevant.