Bima Gram API (IRDAI)

Context

The Bima Gram Application Programming Interface (API) has been rolled out by the INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA (IRDAI).

Its primary purpose is to enhance insurance penetration in rural markets.

The Bima Gram API is developed collaboratively by the following:

NATIONAL INFORMATICS CENTRE (NIC)

MINISTRY OF PANCHAYATI RAJ (MoPR)

DEPARTMENT OF POSTS, represented by the CENTRE OF EXCELLENCE IN POSTAL TECHNOLOGY (CEPT)

INSURANCE INFORMATION BUREAU OF INDIA (IIBI)

Core Functionality

The API contains:

A unified rural database

An Application Programming Interface (API)

It maps:

Postal PIN codes → Local Government Directory (LGD) codes

This allows real-time retrieval of the Gram Panchayat (GP) name.

Operational Use

Insurers simply enter a customer’s postal PIN code, and the API returns:

The corresponding Gram Panchayat name

Instant digital verification of the rural location of the policy

Key Features of Bima Gram API

Designed to streamline and authenticate insurance coverage data in rural India.

Ensures that policies issued in rural areas can be:

Digitally validated

Accurately mapped to the respective Gram Panchayats

Reduces manual documentation and improves:

Accuracy

Speed

Efficiency of rural business reporting

Supports creation of comprehensive baseline data for:

Future policy planning

Resource allocation

Insurance Awareness Committee (IAC-LIFE)

Purpose

The IAC-LIFE is a committee formed to promote insurance awareness, particularly life insurance awareness, across India.

Formed in 2019 under the LIFE INSURANCE COUNCIL.

Comprises 24 life insurance companies, guided by six CEOs nominated to lead the initiative.

Nature of the Committee

Not a statutory body.

Functions as a sectoral advisory and awareness-support body under IRDAI.

Focused specifically on life insurance awareness (hence the suffix “LIFE”).

Bima Trinity (IRDAI)

Concept

The Bima Trinity is a three-pronged strategic initiative launched by the INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA (IRDAI).

Objective: Achieve “Insurance for All by 2047”.

Focus areas:

Accessibility

Affordability

Transparency

Emphasis on rural India through technology-enabled systems and targeted distribution.

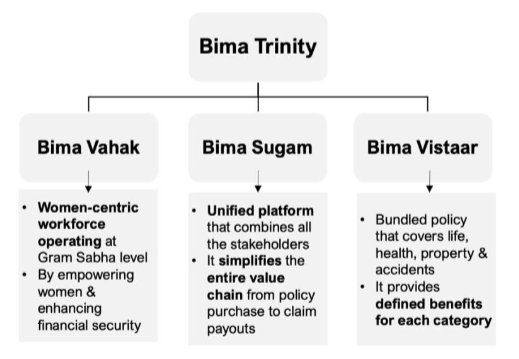

2. Components of the Bima Trinity

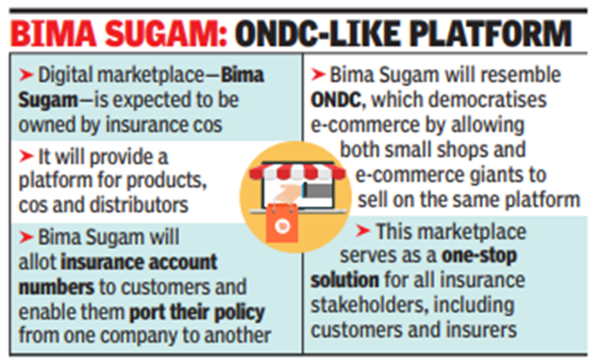

A. Bima Sugam

A unified digital marketplace for all insurance categories:

Life

Health

General

Functions as a one-stop shop for:

Buying

Renewing

Managing policies

Claims settlement

Seamless experience similar to online e-commerce platforms.

Expected to reduce mis-selling, increase product transparency, and simplify policyholder experience.

B. Bima Vistaar

A bundled, affordable insurance product containing:

Life cover

Hospital cash (health)

Personal accident cover

Property insurance

Offers defined benefits, enabling faster settlement without surveyor dependence.

Aimed at low-income and rural households for universal risk protection.

C. Bima Vahak

A women-centric local field force at the Gram Sabha level.

Role:

Conduct awareness on insurance benefits

Assist households in buying insurance (especially Bima Vistaar)

Support claims processes using handheld digital devices

Intended to improve last-mile distribution and build trust in rural communities.

Prelims Practice MCQs

Q. With reference to the Bima Gram API, consider the following statements:

It has been developed by the INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA (IRDAI) to improve insurance penetration in rural areas.

Policies issued in rural regions can be digitally validated and mapped to their respective Gram Panchayats through this API.

The pilot project was tested only by life insurers.

How many of the above statements are correct?

[A] Only one

[B] Only two

[C] All three

[D] None

Correct Answer: [B] Only two

Explanation

Statement 1: Correct.

Bima Gram API is an IRDAI initiative aimed at improving rural insurance penetration.Statement 2: Correct.

The API digitally validates rural insurance policies and maps them accurately to Gram Panchayats.Statement 3: Incorrect.

The pilot included two life insurers, two general insurers, and one health insurer, not life insurers alone.

Q. With reference to Bima Gram, consider the following statements:

It is designed to authenticate and streamline rural insurance coverage data.

The Insurance Awareness Committee (IAC-LIFE) announced that industry-wide integration is already complete.

The API aims to increase accuracy, speed, and efficiency of rural insurance reporting.

How many statements are correct?

[A] Only one

[B] Only two

[C] All three

[D] None

Correct Answer: [B] Only two

Explanation

Statement 1: Correct.

Authentication and streamlining of rural insurance data is one of the core purposes of the API.Statement 2: Incorrect.

The Committee stated that full industry integration is expected soon, not yet complete.Statement 3: Correct.

Digital validation and mapping improve accuracy, speed, and reporting efficiency.

Q. Consider the following statements regarding the Bima Trinity:

It is a strategic initiative of IRDAI aimed at achieving Insurance for All by 2047.

Bima Vistaar is a bundled insurance product covering life, health, personal accident, and property.

Bima Vahak is a digital marketplace for purchasing and renewing insurance policies.

How many of the above statements are correct?

[A] Only one

[B] Only two

[C] All three

[D] None

Correct Answer: [B] Only two

Explanation

Statement 1: Correct. Bima Trinity is IRDAI’s initiative for universal insurance by 2047.

Statement 2: Correct. Bima Vistaar provides comprehensive bundled coverage.

Statement 3: Incorrect. Bima Vahak is a women-led field force, not a marketplace. Bima Sugam is the marketplace.