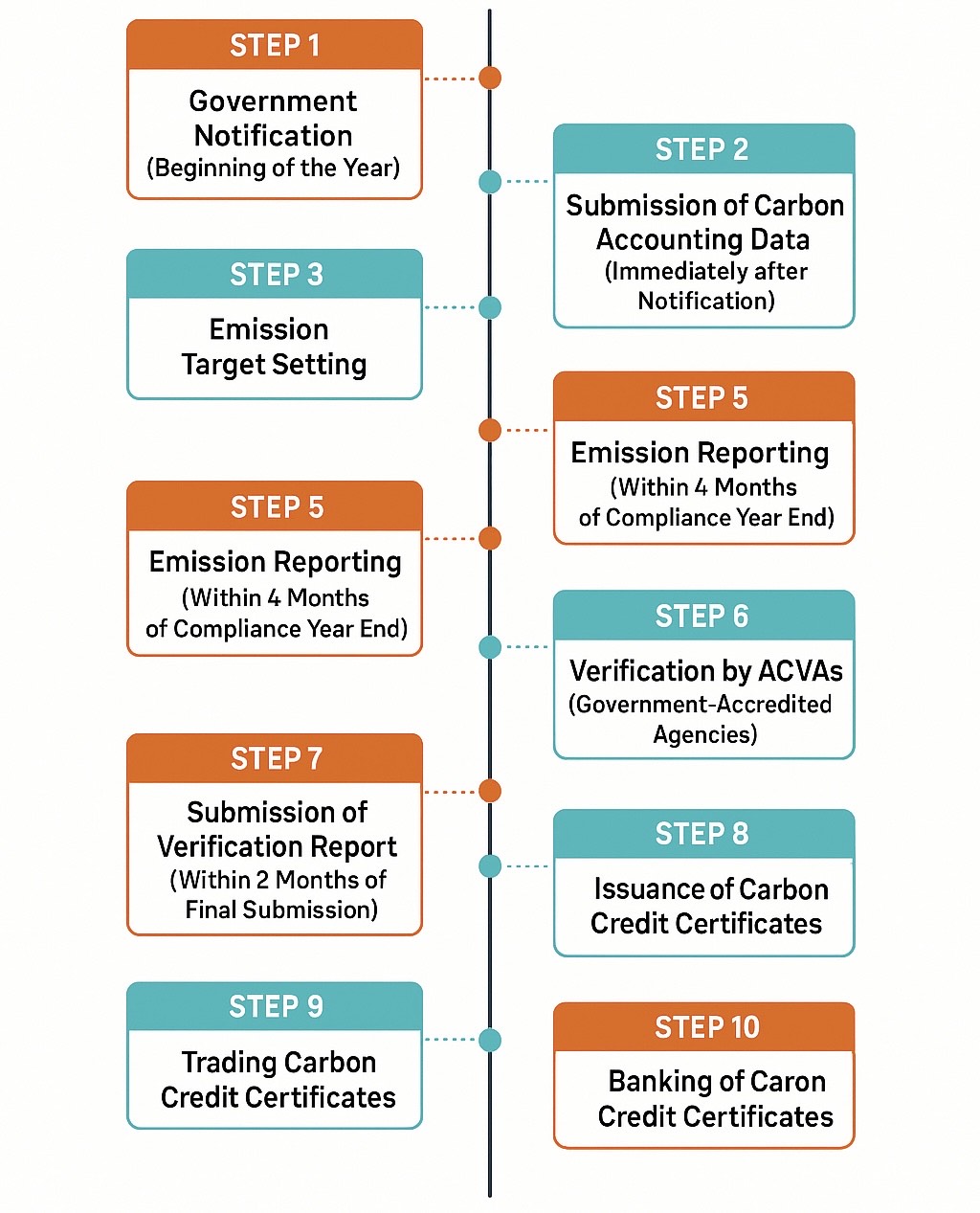

Carbon Credit Trading Scheme (CCTS)

Evaluating India's Carbon Credit Trading Scheme (CCTS) Targets

Theme: Climate Policy, Carbon Markets, Emissions Targets

India’s carbon credit trading scheme (CCTS) must be assessed for ambition at the economy-wide level, not merely at the level of individual entities or sectors. While targets may appear modest at the sector level, aggregate emission intensity reduction is the most important metric for evaluating climate ambition.

Key Points:

1. Target Coverage:

- CCTS applies to 8 heavy industries: aluminium, cement, paper & pulp, chlor-alkali, iron & steel, textile, petrochemicals, and refineries.

-

Targets are set as emissions intensity of production.

2. Why Sectoral or Entity-Level Targets Are Misleading:

-

Sector/entity-level targets only impact financial transfers, not overall emission reductions.

-

Under schemes like PAT, some sectors saw rising energy intensity, but overall economy-wide energy use declined per output unit.

3. Importance of Aggregate Analysis:

-

The real effectiveness of market-based mechanisms lies in economy-wide efficiency, not in uniform improvements across all entities.

-

Emission trading systems (ETS) prioritize total emissions reduction over uniform compliance.

4. Assessment of Ambition:

-

Historical performance under PAT is not a valid benchmark for future ambition.

-

Only comparisons with India’s NDC goals and net-zero pathway (2070) provide meaningful insight.

5. CCTS Target vs Modelling Estimates:

-

Power sector is expected to reduce emissions intensity by 3.44% annually (2025–30).

-

Industry sector’s EIVA projected to decline by 2.53% annually.

-

But current CCTS targets imply a 1.68% annual reduction (2023–27), indicating low ambition in the industrial segment.

| Feature | Carbon Credit Trading Scheme (CCTS) | Perform, Achieve and Trade (PAT) Scheme |

|---|---|---|

| Launched By | Ministry of Power & Ministry of Environment, Forest and Climate Change (MoEFCC) | Bureau of Energy Efficiency (BEE), Ministry of Power |

| Year of Launch | Announced in 2023, implementation began in 2024 | Introduced in 2012 under the National Mission on Enhanced Energy Efficiency (NMEEE) |

| Objective | To reduce greenhouse gas (GHG) emissions intensity through a market-based trading mechanism | To improve energy efficiency in large energy-intensive industries by setting specific energy consumption reduction targets |

| Scope | Focused on carbon dioxide (CO₂) and other GHG emissions reduction | Focused on energy consumption reduction |

| Coverage Sectors | 8 industrial sectors (2024): Aluminium, Cement, Iron & Steel, Pulp & Paper, Textile, Petrochemicals, Refineries, Chlor-alkali | Multiple sectors like Aluminium, Cement, Thermal Power, Iron & Steel, Fertilizer, Pulp & Paper, Textile, and Railways |

| Compliance Mechanism | Entities that overachieve emission intensity targets get carbon credits; underachievers must buy credits | Entities that overachieve energy reduction targets earn Energy Saving Certificates (ESCerts); underachievers purchase ESCerts |

| Nature of Trading | Carbon credits based on emissions intensity reduction per unit output (EIVA) | Energy Saving Certificates (ESCerts) based on Specific Energy Consumption (SEC) targets |

| Monitoring & Verification | Third-party verified emissions data using detailed MRV (Monitoring, Reporting, Verification) protocols | Third-party audits of energy consumption and performance using SEC benchmarks |

| Alignment with International Commitments | Aligned with India’s NDCs under the Paris Agreement and Net Zero by 2070 goal | Focused on energy efficiency goals under National Action Plan on Climate Change (NAPCC) |

| Market Dynamics | More advanced in scope; builds toward carbon pricing architecture in India | Primarily focused on promoting cost-effective energy efficiency in industry |

| Challenges | Initial targets are relatively less ambitious (avg. 1.68% annual EIVA decline vs. 2.53% needed) | Varying performance across sectors; implementation gaps and awareness remain in smaller industries |

What is Carbon Pricing?

-

Economic tool to internalize environmental cost of carbon emissions.

-

Makes polluters pay and incentivizes clean technology.

Economic tool to internalize environmental cost of carbon emissions.

Makes polluters pay and incentivizes clean technology.

Types of Carbon Pricing Mechanisms:

Mechanism Description Emissions Trading System (ETS) Cap-and-Trade or Baseline-and-Credit models allow trading of emissions permits or credits. Carbon Tax Fixed tax per tonne of CO₂ emitted. Predictable cost, but emission outcomes are uncertain. Crediting Mechanism Generates tradable carbon credits from emission reduction projects (e.g., renewables, afforestation).

| Mechanism | Description |

|---|---|

| Emissions Trading System (ETS) | Cap-and-Trade or Baseline-and-Credit models allow trading of emissions permits or credits. |

| Carbon Tax | Fixed tax per tonne of CO₂ emitted. Predictable cost, but emission outcomes are uncertain. |

| Crediting Mechanism | Generates tradable carbon credits from emission reduction projects (e.g., renewables, afforestation). |

India’s CCTS targets, when assessed at the aggregate level, currently fall short of the pace required to align with its NDCs and 2070 net-zero goal. Future policy must aim for progressively stronger targets and broader sectoral modelling to guide ambition.

Syllabus: GS Paper III:

Environment: Conservation,

Economic Development: Infrastructure – Energy

Climate Change: Climate change, carbon credit, and carbon markets