Catastrophe Bonds (Cat Bonds)

-

Catastrophe Bonds (Cat Bonds) are insurance-cum-debt instruments that transfer disaster risk from governments to global investors by securitising risk, enabling faster payouts and reducing reliance on traditional insurers.

-

How They Work:

-

Issued by: Sovereign governments (sponsors) via intermediaries like the World Bank or reinsurers.

-

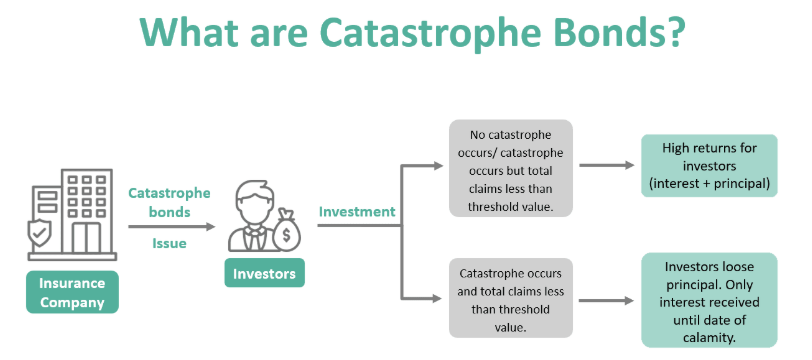

Investors receive high returns (coupon rates) but risk losing principal if a disaster occurs.

-

Payouts are trigger-based, often linked to disaster magnitude thresholds.

-

-

Investor Attraction:

-

Disasters (earthquakes, cyclones) are uncorrelated with financial markets, providing portfolio diversification.

-

Main investors: Pension funds, hedge funds, family offices.

-

Global issuance: $180 billion to date, $50 billion currently outstanding.

-

-

India’s Context:

-

India has low disaster insurance coverage, making the population vulnerable to loss.

-

Rising climate risks (cyclones, floods, earthquakes) make post-disaster funding burdensome.

-

India has already allocated $1.8 billion/year since FY21-22 for disaster mitigation.

-

-

Proposal for South Asia:

-

India could be a lead sponsor of a South Asian Cat Bond to pool regional risks.

-

Shared coverage for hazards like earthquakes in Nepal, Bhutan, India, or cyclones/tsunamis in Bay of Bengal countries.

-

Risk pooling would lower premiums and increase regional resilience.

-

-

Limitations:

-

Trigger design flaws (e.g., no payout if a disaster falls just below threshold).

-

No disaster = no payout, which may be seen as wasteful spending.

-

Transparent comparison between premium costs and historical relief expenditure is essential before adoption.

-

Cat bonds can offer India and South Asia an innovative, cost-effective, and timely financial tool for disaster resilience, but careful design and risk assessment are critical to ensure effectiveness.