EV revolution and battery metals

Context

Despite a continued global expansion of electric vehicles (EVs), battery metals such as lithium, nickel, and cobalt have faced a prolonged price downturn. This reflects a mismatch between technological change and mineral supply planning.

Global EV momentum remains strong

Global EV sales rose 21% year-on-year to 18.5 million vehicles in the first 11 months of 2025.

Growth continues despite:

Rollback of EV subsidies in the United States.

Delay by the European Union in phasing out internal combustion engines beyond 2035.

EV transition is thus structural, not policy-dependent.

China as the engine of EV transformation

China accounts for 62% of global EV sales (2025).

Chinese firms lead both:

EV manufacturing.

Battery technology innovation.

This dominance allows China to reshape global demand for battery metals.

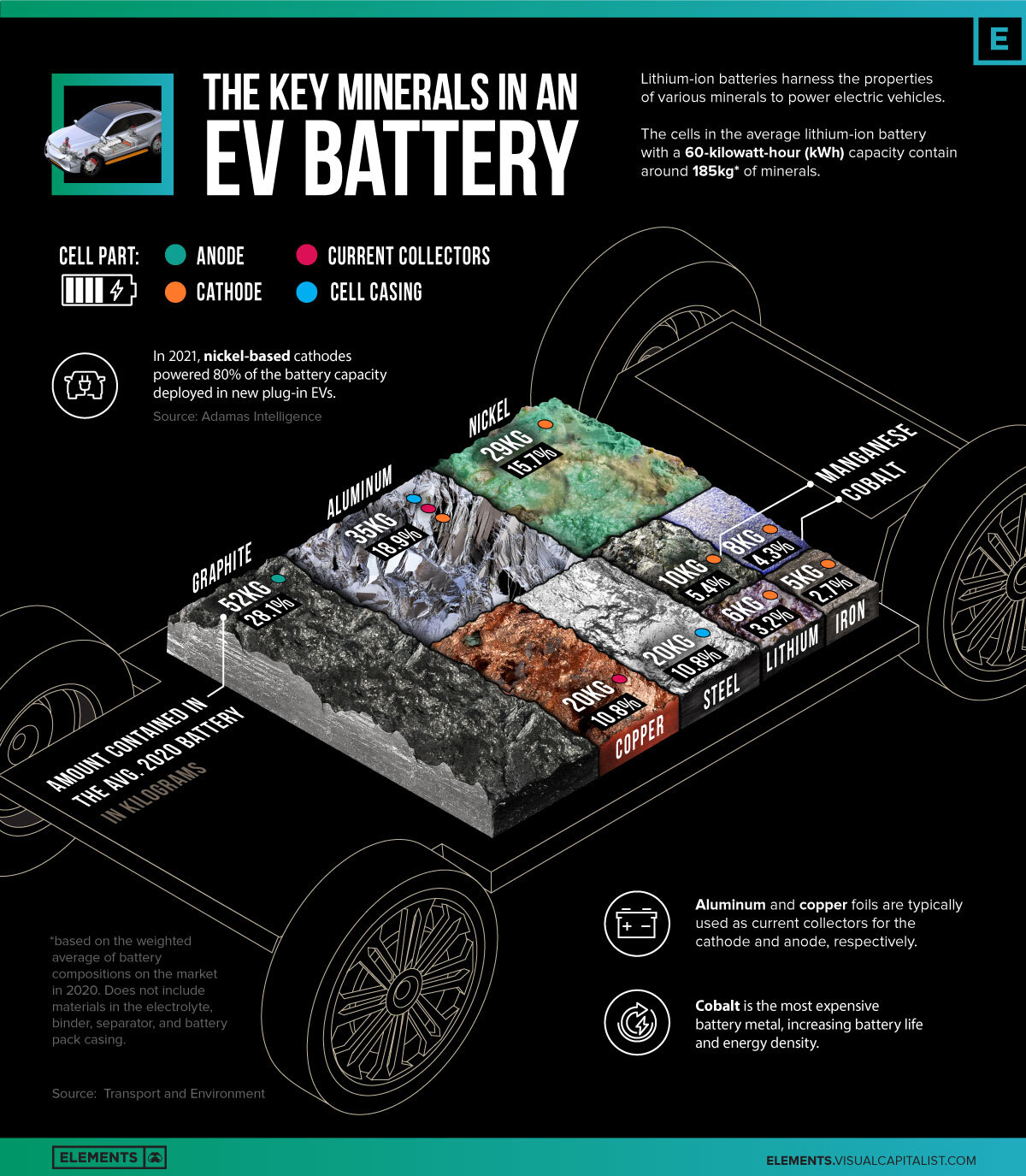

Shift in battery chemistry: LFP vs NCM

Lithium-iron-phosphate (LFP) batteries

Use lithium + iron + phosphate.

Advantages:

Cheaper

Safer (lower fire risk)

Longer life cycle

Performance gap with NCM batteries is narrowing.

Nickel–cobalt–manganese (NCM) batteries

Higher energy density historically.

Depend on nickel and cobalt, which are:

Expensive

Volatile

Ethically sensitive (especially cobalt).

Market shift

LFP share of global EV batteries:

48% (2024)

Projected 65% by 2029 (Macquarie Bank)

Implication: Not all battery metals benefit equally from EV growth.

Impact on major producing countries

Nickel – Indonesia

World’s largest nickel producer.

Continued aggressive output growth despite falling demand from battery sector.

Result:

Massive oversupply.

London Metal Exchange (LME) nickel stocks surged to 338,900 tonnes.

Prices fell below $15,000/tonne, a long-term support level.

London Metal Exchange acts as a barometer of excess supply.

Cobalt – Democratic Republic of the Congo

World’s largest cobalt producer.

Market problems:

Chronic oversupply.

High price volatility.

Ethical concerns due to artisanal mining.

Policy response:

Export suspension (February 2025).

Quota system introduced (October 2025).

Risk:

Poor implementation may cause sudden supply shock, further discouraging automakers from using cobalt.

Lithium: still dominant but facing future competition

Lithium remains central to all mainstream battery chemistries, including LFP.

Deployment:

60,900 tonnes used globally in September 2025.

25% year-on-year growth, matching overall battery growth.

Nickel and cobalt lag significantly (10–15% growth).

Emerging disruptor: Sodium-ion batteries

Developed by CATL.

New generation battery: Naxtra

Features:

Nearly matches LFP efficiency.

Lower cost.

No lithium requirement.

Significance: Potential long-term challenge even to lithium’s dominance.

Prelims Practice MCQs

Q. Lithium-iron-phosphate (LFP) batteries differ from NCM batteries in that they:

a) Do not use lithium

b) Are cheaper and safer but historically had lower energy density

c) Require cobalt as a stabiliser

d) Are unsuitable for electric vehicles

Answer: b

Explanation: LFP batteries use lithium but avoid nickel and cobalt, making them safer and cheaper.

Q. Which country is most affected by declining demand for cobalt due to battery chemistry changes?

a) Chile

b) Australia

c) Democratic Republic of the Congo

d) Peru

Answer: c

Explanation: DRC dominates global cobalt production and is vulnerable to reduced cobalt use.

Q. Sodium-ion batteries are significant because they:

a) Completely eliminate the need for batteries

b) Replace electric motors

c) Reduce dependence on lithium and critical minerals

d) Are suitable only for stationary storage

Answer: c

Explanation: Sodium-ion batteries reduce reliance on lithium, potentially reshaping mineral geopolitics.