Geopolitical premium

What is geopolitical premium in oil prices?

Geopolitical premium refers to the extra price added to crude oil due to fears of supply disruption arising from wars, sanctions, or political instability in major oil-producing regions.

Why 2025 was expected to see high oil volatility

Return of Donald Trump with aggressive foreign policy.

Israel–Iran military confrontation (June 2025).

US air strikes on Iranian nuclear facilities.

Ukrainian attacks on Russian oil infrastructure.

Sanctions on major Russian oil companies.

Historically, such events triggered sharp and sustained oil price spikes.

What actually happened in 2025

Brent crude rose only temporarily from ~$69 to ~$78.85.

Prices quickly fell back after a US-brokered ceasefire.

Overall 2025 price band remained narrow: $60–$81.

No sustained “panic rally” despite severe geopolitical shocks.

This marked a clear departure from 2022, when prices surged close to $130 after Russia invaded Ukraine.

Key reason: The age of energy abundance

1. Supply glut

United States became the world’s largest oil producer (13.84 million bpd).

Growth driven by:

Permian shale basin

Gulf of Mexico

Strong LNG exports also reduced global energy stress.

2. OPEC+ strategy shift

2. OPEC+ strategy shiftOPEC+ reversed production cuts.

Increased output through 2025 despite weak price response.

3. Non-OPEC expansion

Rising output from Argentina, Brazil, Canada, Guyana.

4. Oversupply outlook

International Energy Agency projects nearly 4 million bpd surplus in 2026.

Why markets ignored traditional flashpoints

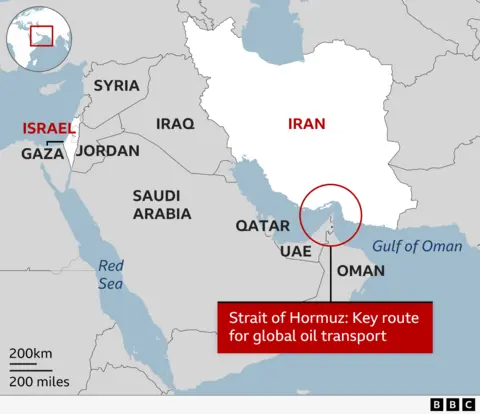

Strait of Hormuz

Nearly 20% of global oil passes through Strait of Hormuz.

Earlier assumption: any Iran-US conflict would block it.

Reality in 2025: No physical disruption, hence muted price reaction.

Russia-Ukraine dimension

Ukrainian strikes on Russian refineries.

Sanctions on Rosneft and Lukoil (5% of global output).

Markets discounted risks due to past experience (sanctions in 2022 failed to curb Russian exports).

Prelims Practice MCQs

Q. The term “geopolitical premium” in oil markets refers to:

a) Tax imposed on oil imports during wars

b) Extra price added due to fear of supply disruptions

c) Insurance cost on oil tankers

d) OPEC-mandated minimum price

Answer: b

Explanation: Geopolitical premium reflects price rise due to perceived risk, not actual disruption.