India’s Maize Yield, Ethanol Blending, and Import Dependence

Current Status

Maize Yield in India: ~4 tonnes per hectare (global average ~6 tonnes per hectare).

Production (2024–25): ~50 million tonnes.

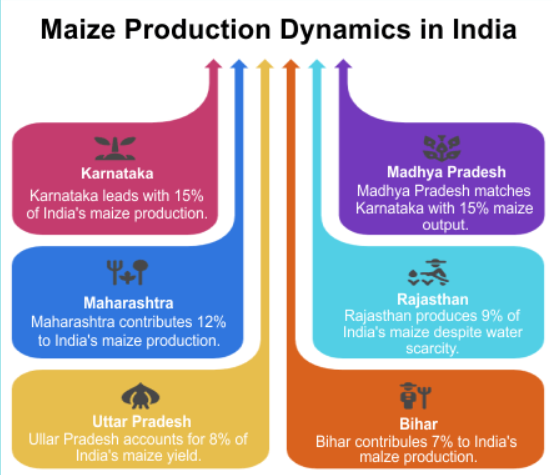

Top maize producing states-->1st Karnataka>2nd Madhya Pradesh>3rd Maharashtra>4thUttar Pradesh>5th Bihar

Usage:

Poultry & livestock feed.

Human consumption.

Growing demand from ethanol blending programme.

Ethanol Blending & Maize Diversion

India aims for 20% ethanol blending by 2025–26.

Traditionally dependent on sugarcane (molasses, juice), now maize is being diverted.

2024–25 maize allocation: ~10–12 MT (out of 50 MT) for ethanol.

Policy challenge: Food security vs. Fuel security.

Import Trends

Maize imports (2024–25): ~1 million tonnes.

~60% from Myanmar.

Remainder mostly from Ukraine.

Imports rose 8x compared to previous year → largely for ethanol use.

GM Dimension

India’s position on GM crops:

Allowed: GM Cotton.

Pending: GM Mustard, GM Brinjal.

No import of U.S. corn (mostly GM).

Concerns:

GM corn in food chain → toxicity, diseases, ecological impact.

Public resistance to GM food.

Why the U.S. Wants to Export to India

1. Nature of U.S. Agriculture

Highly Capitalist & Industrialized:

Average U.S. farm: ~500 acres.

Only ~3 million people engaged in ~2 million farm operations.

Farming is agribusiness-oriented, not subsistence.

High Productivity:

U.S. maize yield is ~3× India’s yield.

Annual U.S. corn production: ~350 MT.

Surplus drives export dependence.

2. Role of Cash Crops (Corn & Soybean)

Corn = backbone of U.S. farming, but:

Marginal direct consumption by humans.

Major use: ethanol production, HFCS (sweetener), bioplastics, animal feed for CAFOs.

U.S. exports ~45 MT corn annually → needs global markets to absorb surplus.

3. WTO and Subsidy Pressures

WTO disciplines forced cuts in direct farm subsidies.

U.S. shifted to counter-cyclical payments & support to agribusinesses.

To sustain profitability, exports became strategic outlet.

4. Targeting India

India’s ethanol blending programme (20% by 2025–26) creates massive maize demand.

India’s maize production (~50 MT) is stretched between food, feed, and ethanol.

Imports already rising (1 MT in 2024–25, 8× growth in one year).

U.S. wants to supply corn for India’s ethanol and livestock sectors.

5. Strategic Drivers

Market Expansion: U.S. corn surplus needs new, large, stable buyers → India fits.

Trade Diplomacy: U.S. can push for maize access in trade negotiations (e.g., Indo-U.S. Trade Policy Forum).

GM Corn Factor: Most U.S. corn is GM. Exporting to India could indirectly push acceptance of GM crops.

Political Stakes Behind Corn and Soybean Exports

1. Geography and Political Base

Corn Belt & Midwest: Iowa, Illinois, Indiana, Nebraska, Minnesota → Republican heartland.

Soybean Production: Similarly concentrated in the Midwest.

California & Specialty Crops: Fruits and vegetables, Democrat stronghold.

Implication: Crop choices and regional production overlap with partisan geography, shaping political stakes.

2. Electoral Politics (Primaries & Iowa Effect)

The U.S. Presidential primary season starts in Iowa, a top corn-soy State.

Candidates cannot afford to ignore the corn lobby or policies like ethanol blending.

A pro-corn/soy stance becomes a political litmus test in early campaigns.

3. Lobbying Power

Agribusiness lobbies (corn refiners, soybean processors, ethanol producers) exert huge influence in Congress and Senate.

Farm Bills and subsidies are shaped as much by agribusiness interests as by nutrition or food security needs.

Even under Biden, lobbyists pushed in India for U.S. corn access for ethanol blending, showing bipartisan lobbying.

4. China Factor

China was the largest buyer of U.S. soybeans.

Post U.S.-China trade war, China cut imports and shifted to Brazil.

Result: Surplus soybean glut in Midwest → farmers pressurize government for alternative markets.

This creates both domestic economic stress (farm incomes) and political anger, especially in swing states.

5. Economic-Political Chain Reaction

Good harvests (like the current year) heighten the need for foreign markets.

Without exports, prices crash, farmers lose income, and rural discontent rises.

Since rural Midwest = Republican core, farmer distress can shake electoral outcomes.

6. Partisan Identity & Policy Differences

Republicans: Prioritize large-scale capitalist farming, ethanol mandates, pro-export policies.

Democrats: More support for nutrition programs, food security, and sustainability, though they also accommodate agribusiness lobby.

But neither party ignores corn/soy because of their vote-bank role in swing states.

Stakes for India in Importing U.S. Corn

1. Political Constraints

GM Crop Freeze: India currently allows only GM cotton; brinjal and mustard are under trial. Importing U.S. GM corn would spark political and public backlash.

Mexico’s Experience: Cheap U.S. corn under NAFTA displaced over a million Mexican farmers. India fears a similar outcome — mass farmer distress if cheap U.S. corn floods the market.

Electoral Angle: States like Bihar, where farmers are shifting to maize, are politically sensitive. Approving imports before elections could hurt the ruling party’s support base.

2. Economic Stakes

Price Undercutting: U.S. corn is about 30% cheaper than Indian maize. Imports could lead to “dumping,” destabilising India’s domestic maize ecosystem.

Maize Ecosystem Building:

India’s maize production has nearly doubled in 2–3 years.

Kharif acreage rose by 10.5 lakh hectares recently.

Cheap imports could destroy this momentum, leaving new maize farmers in distress.

Ethanol Supply Chain: India has aligned farmers, ethanol plants, and oil companies around maize-based ethanol. Disrupting this would weaken long-term energy security plans.

3. Strategic Stakes

Energy Security: Ethanol blending (20% target) can cut India’s oil import bill by $10 billion annually, keeping that money within the domestic economy. Importing feedstock (like corn) for ethanol blending defeats this purpose.

Food vs Fuel Balance: Domestic maize ensures flexibility in balancing food security (poultry, feed, starch industries) and fuel needs. Imports tie India into global market volatility.

4. Socio-Environmental Stakes

Farmer Livelihoods: Cheap imports would harm smallholder farmers who depend on maize for income.

Rural Economy Multiplier: Increased maize cultivation is already spurring rural employment in transport, storage, and ethanol plants. Imports would reduce these gains.

Carbon Goals: Importing corn adds shipping emissions, undermining the green credentials of India’s ethanol programme.