Industrial credit–growth disconnect

Core issue

A puzzling decoupling between industrial credit growth and industrial GDP growth during 2016–17 to 2018–19, which raises concerns about possible overestimation of industrial GDP in the current national accounts series.

Industrial credit Industrial credit means money that banks lend to factories, manufacturing units, and industrial companies so that they can run and expand their businesses. | ||

Role of bank credit in industrial growth

The banking system channels household savings to firms, enabling investment, capacity expansion, and productivity growth.

Historically, industrial credit and industrial output move together, reflecting real sector demand.

Key facts

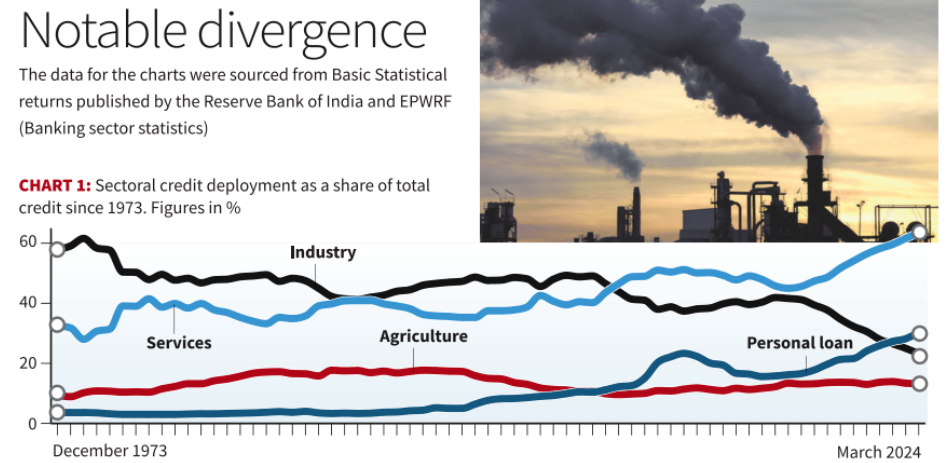

Fact 1: Sharp fall in industrial credit share

Industrial credit share in total bank credit declined from 42% (2013) to 23% (2024).

This is unprecedented in ~50 years.

Credit has increasingly shifted to services and personal loans, which now exceed industrial credit.

Indicates financialisation of consumption over production.

Financialisation of consumption Financialisation of consumption means people are increasingly using loans and credit to buy everyday goods and services, instead of paying mainly from their income or savings. | ||

Fact 2: Abysmal growth of industrial credit

CAGR (2014–24): ~4.1%, compared to:

1974–90: ~16%

1990–04: ~14%

2004–14: ~23%

Even excluding COVID years, 2014–19 growth remains ~4.1%.

Inference: Structural slowdown, not a cyclical blip.

Fact 3: Region- and industry-wide stagnation

Major industrial regions (western, southern, northern) grew below national average.

Higher growth in central and northeastern regions likely reflects low base effects.

No major industry group recorded double-digit credit growth during 2014–24.

Contrast: 2004–14 saw double-digit growth across all industry groups.

Fact 4: Stagnation in financial deepening

Bank credit/GDP ratio:

Rose sharply in late 1990s (~20%) and early 2010s (>50%).

Stagnated at 50–55% since then.

International comparison:

Japan ~1.2

China ~1.9

South Africa ~0.9

Brazil ~0.75

India’s credit stagnation + falling industrial share signals weak investment financing.

The puzzle: FY17–FY19 decoupling

What diverged?

Industrial GDP growth (NAS) remained surprisingly stable.

Industrial credit growth slowed sharply.

Formal manufacturing output (ASI GVA) showed a downturn.

Why is this unusual?

Long-term correlation between industrial credit and ASI-GVA growth is strong:

1981–2024: 0.45

2000–2024: 0.56

Since 2004: 0.63

2004–2020 (pre-pandemic): 0.82

Under normal conditions, credit and output move in near lockstep.

Implications for GDP measurement

The FY17–FY19 decoupling lends credence to the argument that industrial GDP may be overstated in the current National Accounts Statistics (NAS) 2011–12 series.

Especially relevant as the International Monetary Fund has assigned India’s GDP estimates a ‘C’ rating, signalling data quality concerns.

Inputs-based measures (credit, ASI) contradict output-based industrial GDP during this period.

Possible reasons for weak industrial credit

Post-NPA crisis risk aversion by banks.

Shift towards retail and personal loans (lower risk, higher margins).

Corporate deleveraging and alternative financing.

Measurement issues in industrial GDP estimation.

Broader concern

Weak credit to industry undermines investment-led growth, job creation, and manufacturing expansion.

Way forward

The FY17–FY19 episode represents a structural anomaly, not a statistical coincidence.

It underscores the need to:

Re-examine GDP estimation methodology,

Strengthen industrial credit transmission,

Rebalance finance from consumption to production.

Prelims Practice MCQs

Q. The term financialisation of consumption is best described as:

A. Increasing use of financial derivatives by manufacturing firms

B. Rising household spending financed through credit and loans

C. Expansion of financial services sector relative to agriculture

D. Monetisation of household savings through capital markets

Correct Answer: B

Explanation:

Financialisation of consumption refers to households increasingly using credit (personal loans, credit cards, EMIs) to finance consumption, rather than relying mainly on income or savings.

Q. With reference to industrial credit in India, consider the following statements:

The share of industrial credit in total bank credit has consistently increased since 2013.

Personal loans have recently surpassed industrial credit in share of total bank credit.

A decline in industrial credit share is unprecedented in the last five decades.

Which of the statements given above is/are correct?

A. 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

Correct Answer: B

Explanation:

Statement 1 is incorrect: industrial credit share declined sharply from 42% (2013) to 23% (2024).

Statement 2 is correct: personal loans overtook industrial credit.

Statement 3 is correct: such a decline is unprecedented in ~50 years.