Labour Codes notified

Context

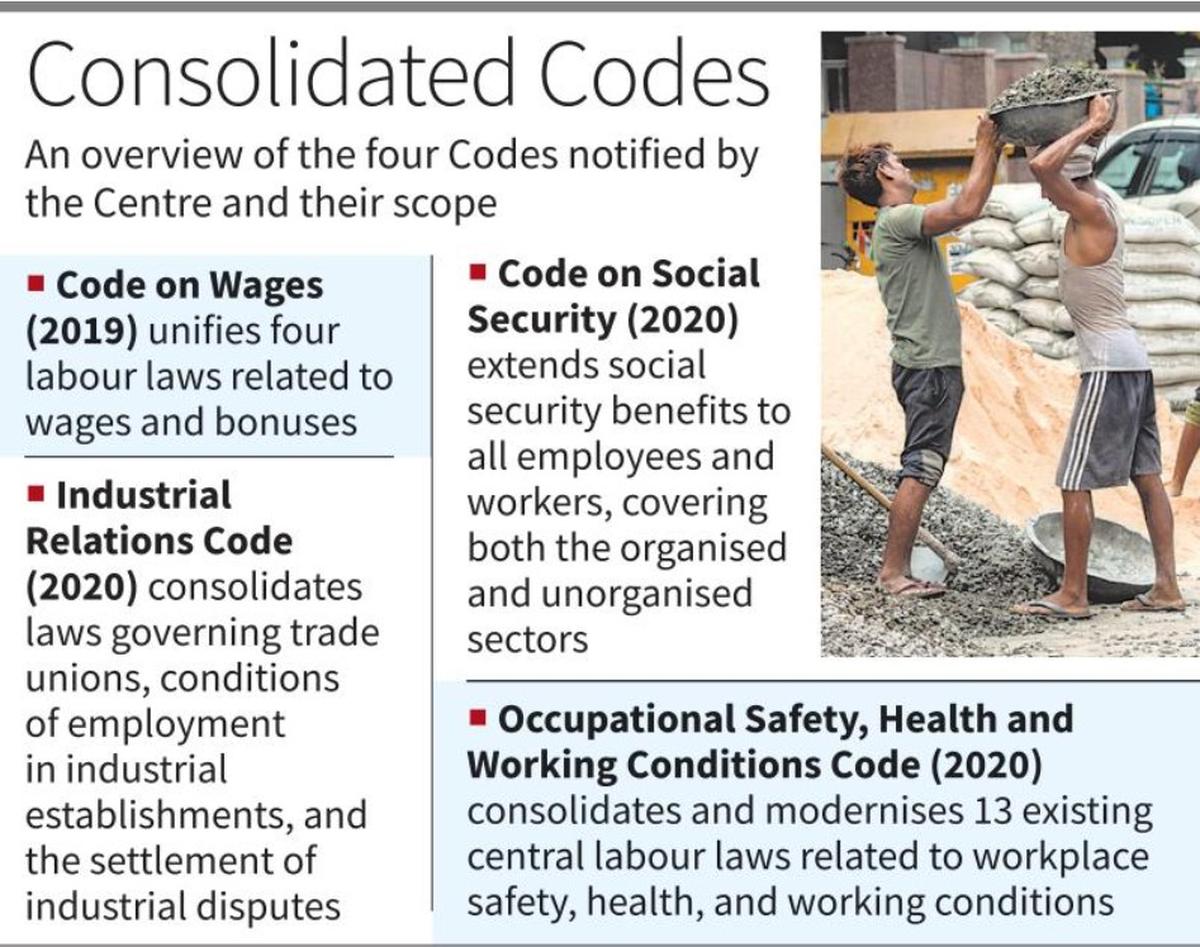

Parliament passed four Labour Codes between 2019–2020, consolidating 29 existing labour laws.

The Union Government notified their implementation for provisions that do not require fresh rule-making.

Draft rules (published earlier) will be revised and placed in public domain for 45 days for consultation before full implementation.

States can now notify rules in their domain.

Four Labour Codes

Code on Wages, 2019

Industrial Relations Code, 2020

Code on Social Security, 2020

Occupational Safety, Health and Working Conditions Code, 2020

Key Changes Introduced

Appointment and formalisation

Mandatory appointment letters for all workers → drives formalisation.

Earlier no statutory requirement.

Social Security coverage

Coverage extended to all workers, including

Gig workers

Platform workers

Fixed-term employees

Aggregators must contribute 1–2 per cent of annual turnover, capped at 5 per cent of payments to gig/platform workers.

Minimum wages

Statutory minimum wage applicable to all employments, not only scheduled industries.

Health and safety

Mandatory free annual health check-ups for workers above 40.

Women allowed to work at night and in all job categories with adequate safeguards.

Wage and employment conditions

Timely payment of wages mandatory.

Equal benefits for fixed-term employees as permanent employees.

Gratuity eligibility for fixed-term employees reduced to 1 year (earlier 5 years continuous service).

ESIC and social protection

ESIC coverage extended pan-India, including previously uncovered regions.

Compliance reforms

Reduction of compliance burden:

Single registration

Single licence

Single return

Replaces multiple registrations and licences under 29 laws.

Implications

For workers

Greater protection, social security, universal minimum wages.

Enhanced safety, formalisation, and transparency.

Special benefits for gig/platform workers and fixed-term employees.

For employers

Simplified compliance regime.

Need to restructure wage components due to new definitions.

Higher financial obligations (contributions for gig/platform workers).

For economy

Moves towards a unified labour market, supporting investment and ease of doing business.

Push toward formalisation could increase workforce documentation and productivity.

Prelims Practice MCQs

Q. Which of the following provisions is explicitly introduced under the new Labour Codes?

Mandatory appointment letters for all workers

Mandatory free annual health check-up for all workers

Gratuity for fixed-term employees after one year

Statutory minimum wages across all employments

Select the correct answer:

a) 1, 3 and 4 only

b) 1, 2 and 4 only

c) 1, 2, 3 and 4

d) 2 and 3 only

Answer: c)

Explanation: All four are directly provided under the Codes: appointment letters, health check-up for 40+ workers, gratuity after one year for fixed-term workers, and universal minimum wages.

Q. Under the Code on Social Security, aggregators must contribute to the social security fund for gig and platform workers. This contribution is:

a) 1–5 per cent of annual turnover

b) 1–2 per cent of annual turnover, capped at 5 per cent of payments to workers

c) 2–3 per cent of annual turnover

d) 5 per cent of total workforce compensation

Answer: b)

Explanation: Contribution range: 1–2 per cent of annual turnover, but cannot exceed 5 per cent of the amount payable to gig/platform workers.