Venezuela crisis and India’s energy security

Context

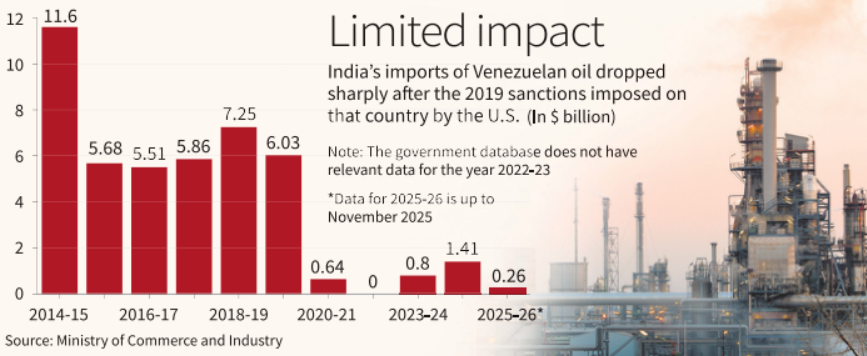

The recent U.S. military action in Venezuela and statements regarding control over Venezuelan oil have raised concerns globally. However, India’s energy security remains largely insulated from these developments.

Key facts

India’s crude oil import from Venezuela (FY 2025–26 till Nov):

$255.3 million, about 0.3% of total oil importsPeak import (2013): ~$13 billion

Trend since 2019: Sharp decline due to U.S. sanctions and threat of secondary sanctions

Venezuela’s share:

~3.5% of OPEC exports

~1% of global oil supply

Why India’s energy security is not significantly affected

1. Marginal trade exposure

India’s dependence on Venezuelan crude is negligible, making supply disruptions economically insignificant.

2. Sanctions already factored in

India has gradually disengaged since 2019

Trade disruption is not a new shock, but an already-adjusted reality

3. Nature of Venezuelan crude

Venezuelan oil is heavy and extra-heavy crude

Requires specialized refineries

Most Indian refineries are optimized for Middle Eastern crude blends

4. Diversified import basket

India sources crude from:

West Asia (Saudi Arabia, Iraq, UAE)

Russia

Africa

Latin America (limited)

This diversification cushions geopolitical shocks.

OPEC angle

Organization of the Petroleum Exporting Countries (OPEC) influences prices and supply

Despite being an OPEC member, Venezuela’s actual production is low

Hence, instability in Venezuela does not materially affect OPEC’s overall output strategy

What is OPEC

Organization of the Petroleum Exporting Countries is an intergovernmental organization

Objective:

Enable cooperation among major oil-producing and oil-dependent countries

Collectively influence global oil markets

Maximize returns from petroleum resources

Operates through coordinated production policies.

Foundation and origin

Founded: 14 September 1960

Place: Baghdad (Iraq)

Founding members (5):

Iran

Iraq

Kuwait

Saudi Arabia

Venezuela

Membership

Current members: 12 countries

Membership is dominated by:

Middle Eastern

African

Latin American oil producers

Members pay equal membership fees irrespective of production size.

OPEC membership (as of January 2026)

Total members: 12

Current member countries

Africa (6):

Algeria

Republic of the Congo

Equatorial Guinea

Gabon

Libya

Nigeria

Middle East (5):

Iran

Iraq

Kuwait

Saudi Arabia

United Arab Emirates

South America (1):

Venezuela

Africa has more OPEC members than the Middle East

Countries no longer in OPEC

Angola – Withdrew effective 1 January 2024

Qatar – Left in January 2019

Ecuador – Not a current member

Indonesia – Not a current member

Membership in OPEC is not permanent

Share in global oil economy

Global oil production share (2022): ~38%

Global proven oil reserves: ~79.5% located in OPEC countries

Middle East share:

~67.2% of OPEC’s total proven oil reserves

Key inference:

OPEC’s power lies more in reserves and spare capacity than current production alone

Organisational structure

OPEC Conference (Supreme authority)

Highest decision-making body

Composed of:

Delegations headed by oil ministers of member countries

Functions:

Sets overall policy

Decides production targets

Meetings:

At least twice a year

Extraordinary sessions when required

Secretariat

Headed by OPEC Secretary General

Executes decisions of the Conference

Provides research, data, and coordination support

Headquarters

Vienna, Austria

All ordinary Conference meetings are held here

Decision-making principles

Unanimity

One member, one vote

Equal budget contribution despite unequal production capacities

(voting power is not proportional to output)

Saudi Arabia’s special position

Saudi Arabia is:

Largest oil exporter within OPEC

Possesses substantial spare production capacity

Acts as:

Swing producer — increases or cuts output to stabilize global prices

Hence regarded as:

OPEC’s de facto leader (informal, not institutional)

Prelims Practice MCQs

Q. The original founding members of OPEC include:

Iran

Iraq

Kuwait

Saudi Arabia

Qatar

Venezuela

Select the correct answer using the code below:

(a) 1, 2, 3, 4 and 6 only

(b) 1, 2, 3, 4 and 5 only

(c) 2, 3, 4, 5 and 6 only

(d) 1, 3, 4, 5 and 6 only

Answer: (a)

Explanation:

Qatar was not a founding member.

Q. According to recent estimates, OPEC countries account for approximately:

(a) 25% of global oil production and 40% of proven reserves

(b) 38% of global oil production and about 80% of proven reserves

(c) 50% of global oil production and 50% of proven reserves

(d) 60% of global oil production and 90% of proven reserves

Answer: (b)

Explanation:

OPEC controls a much higher share of reserves than production.